Free Advice For Deciding On An RSI Divergence Strategy

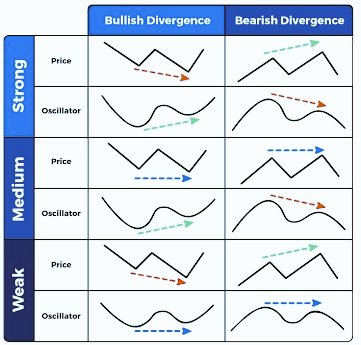

Ok, let's start by asking the most obvious question. Let's look at the meaning behind RSI Divergence really is and what trading signals we can take away from it. A divergence occurs when the price movement is not aligned with the RSI indicator. This means that when the RSI and the price action are out of sync, a divergence occurs on the chart. In a market with a downward trend, price makes lower highs, while the RSI indicator makes an upper low. The divergence is when the indicator is not in accordance with price movement. When this happens it is essential to keep an eye on the market. The chart clearly shows both bullish RSI divigence as well as bearish RSI divigence. In this way, the price action reversed immediately following every RSI Divergence signal. Let's move on to the fascinating topic. Follow the recommended cryptocurrency trading for blog recommendations including cryptocurrency trading, forex trading, automated crypto trading, forex backtesting, software for automated trading, RSI divergence, bot for crypto trading, forex backtesting software free, divergence trading forex, backtesting strategies and more.

How Do You Analyze Rsi Divergence?

Since we use the RSI indicator for identifying trend reversals, it is crucial to determine the right trend reversal, to do that, first we need to have an uptrending market. Then we use RSI divergence to find the weak points in the current trend and then we can utilize that information to identify the trend reversal at the appropriate time.

How Do You Recognize Rsi Divergence During Forex Trading

At the beginning of the trend the two indicators RSI indicator and Price Action performed the same process by making higher highs. This signifies that the trend is strong. The trend ended with Price reaching higher highs towards the end. However, the RSI indicator was able to reach lower highs. This indicates the chart is worth watching. This is where we need to pay attention to the market, because both the indicator and price action are out of sync which implies that there is an RSI divergence, isn't it? In this case, the RSI divergence is a sign of bearish tendency rotation. Check out the chart to observe the changes that happened after the RSI diversification. Look at the RSI divergence is highly accurate when it comes to detecting trend reversals. The question ishow do you spot the signs of a trend reversal? Let's take a look at four strategies for trade entry that can be combined with RSI Divergence to provide better entry signals. Check out the recommended backtesting trading strategies for more advice including backtesting strategies, crypto trading, crypto trading backtester, position sizing calculator, automated trading software, bot for crypto trading, backtesting tool, trading platform cryptocurrency, crypto trading, position sizing calculator and more.

Tip #1 – Combining RSI Divergence & the Triangle Pattern

Triangle chart patterns come in two variations. There is an Ascending triangular pattern which is used in an downtrend. The pattern of the descending triangle can be used to reverse the trend of a market in an uptrend. Below is the descending triangle pattern. Just like the previous example when the market was in an uptrend but then it began to decrease. RSI is a signal of divergence too. These indicators reveal the weak points in this uptrend. In the present, we can discern that the uptrend is slowing down. As a result, the price has formed the downward triangle. This indicates that the trend is changing. It's now time for short-term trading. The techniques for breakout used in this trade were the same as those used previously mentioned. Now let's look at the third strategy for gaining entry into trades. We'll be pairing the trend structure with RSI divergence. Let's take a look at how you can trade RSI divergence when the trend is changing. See the best backtesting platform for blog info including forex tester, cryptocurrency trading bot, RSI divergence cheat sheet, trading platform crypto, backtester, trading divergences, backtesting, backtesting tool, backtesting tool, software for automated trading and more.

Tip #2 – Combining RSI Diversity with the Head and Shoulders Pattern

RSI divergence assists forex traders in recognizing market reverses. It is possible to increase the probability of trading by combing RSI diversification with other reversal factors for example, the Head or shoulders pattern. Let's take a look at ways to make trades more profitable by combing RSI diversification with the Head and Shoulders Pattern. Related - Trading Head and Shoulders Patterns in Forex: A Reversal Trading Method. Before committing to trades, it is important that you have an appropriate market. Trending markets are better because we're looking for an inverse trend. Check out the chart below. Follow the recommended cryptocurrency trading for blog info including automated crypto trading, backtester, forex backtester, backtesting trading strategies, cryptocurrency trading bot, RSI divergence cheat sheet, best forex trading platform, trading divergences, forex backtesting software, forex backtesting software and more.

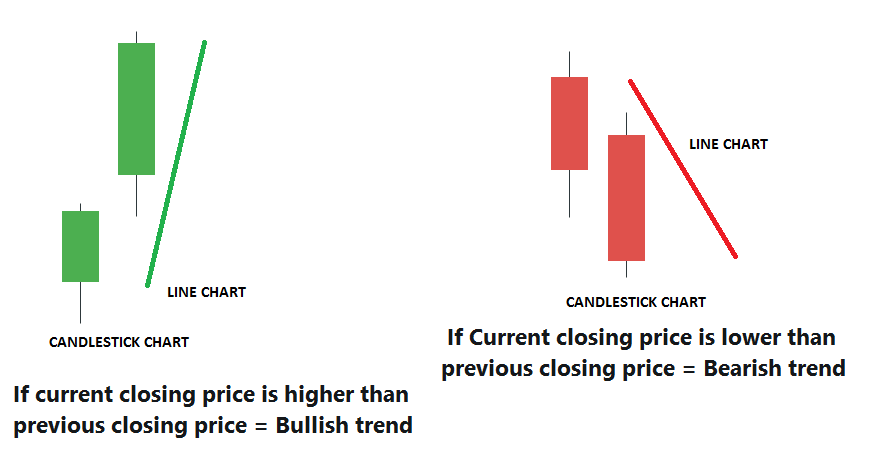

Tip #3 – Combining RSI Diversity and the Trend Architecture

Trend is our best friend. So long as the market is trending, we need to be trading in the direction of the trend. This is what professionals teach. But the trend isn't ever going to stop, at some point , it's going to turn around, right? Let's now see how to detect reversals using the structure of the trend and RSI divergence. We all know that uptrend is making higher highs while the downtrend is making lower lows. Now with that in mind have a look at the chart below. You can see it is an upward trend, with a lower series of lows and higher highs. Next, let's take a glance (Red Line) at the RSI divergence. The RSI creates higher lows while price action causes them. What does this tell us? Even though the market creates low RSI is the reverse. This suggests that the current downtrend is losing momentum. We should be ready for a potential reversal. Check out the recommended trading divergences for more info including backtesting strategies, automated forex trading, forex tester, position sizing calculator, backtesting tool, forex backtesting software free, forex tester, backtesting, divergence trading, online trading platform and more.

Tip #4 – Combining Rsi Divergence With The Double Top And Double Bottom

A double top (or double bottom) is a pattern of reversal that occurs after a prolonged move or a trend. The double top is formed when the price has reached an amount that is unbreakable. broken. After that level is attained, the price will fall slightly, then come back to test the earlier level. If it bounces once more from that level, then you have an option to double your options. Have a look at this double top. The double top that you see above shows two tops that were formed from a strong move. The second top is unable to over the first. This is a strong indication that the buyers are struggling to move higher. Double bottoms use the same concepts, however in a different way. We employ the breakout trading strategy. In this case we will sell the trade once the price drops below the trigger line. The price surpassed our profit target within a matter of days. Quick Profit. Double bottom also requires the same trading techniques. Take a look at the graph below to learn how you can trade RSI divergence using double bottom.

Remember that this isn't the only strategy that works for all traders. There is no perfect trading strategy. Every strategy for trading has losses, and these losses are inevitable. While we earn consistent profit using this strategy, but, we do have a strict risk-management system and a quick way to reduce our losses. This will enable us to limit drawdowns as well as open the doors to huge upside possibilities.

Comments on “Great News For Picking Forex Backtesting Platforms”